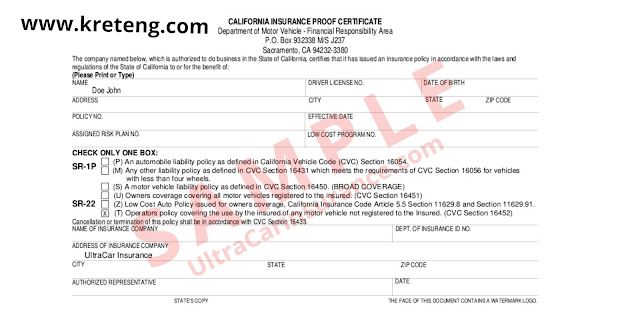

If you have actually a document of not being as risk-free a chauffeur as you ought to be, you might have to appearance right into obtaining SR22 car insurance coverage. SR22 isn’t truly a kind of protection, however is a file you get with your insurance coverage if you are deemed being a high danger chauffeur. It’s typically needed for any type of driver that might have previous roadway infractions. When an SR22 is provided by an insurance provider, it needs to be provided for your regional DMV in purchase to acquire high danger car insurance coverage.

Insurance provider typically offer and SR22 declaring. This is needed while you’re getting your quotation from car insurance provider. When you purchase your insurance coverage, you will get the SR22 develop with your insurance coverage paperwork.

That needs SR22 Insurance coverage?

Different kinds of chauffeurs need SR22 develop. These consist of DUI chauffeurs, individuals that were captured owning without insurance coverage and chauffeurs with various other kind of infractions. If you’re considered to be high danger chauffeur, you’ll most likely need to stay in this classification for a specific quantity of time.

For the length of time do I require SR22 insurance coverage for?

If you have actually been owning without protection, you might have to have an SR22 obligation protection file for as much as 3 years. If you’re a DUI chauffeur, it might be needed for as long as 5 years.

Exactly just how could I reduce the set you back of SR22 Insurance coverage?

You might not have the ability to obtain truly inexpensive car insurance coverage, however it’s feasible to decrease the set you back of SR22 develop. Investigating your choices is an vital part of the procedure. This isn’t as challenging as it seems. The web has assisted make this also simpler. The majority of the primary insurance providers have their very own site, where you could rapidly obtain a estimate. When you have a variety of estimates you could contrast each cost and discount rates to discover which fits your requirements. If you are uncertain regarding where to discover the very best offers, the enhance in social networks and various other sites could be a huge assistance as well. These websites allow individuals that have purchased insurance coverage items compose evaluates regarding their experiences with various insurance providers and insurance coverage items. Eliminating unneeded insurance coverage is one more method to reduce the set you back. Accident and extensive protection could be eliminated if you are on a limited budget plan.

At completion of the day, altering your owning practices is the very best method to ultimately decrease your insurance coverage prices. Owning securely and preventing any type of web website traffic infractions is the just method to reveal insurance providers that you’re currently much more secure when driving. When you have shown this for a specific time period, an insurance provider will be much a lot extra most likely to provide you a reduced insurance coverage estimate.

When you are searching for high danger car insurance coverage, numerous chauffeurs really feel that they’ll need to pay a lot much a lot extra for their insurance coverage, compared to they formerly did. Nevertheless this isn’t constantly the situation. The much a lot extra you research study and appearance for guidance, the higher the possibility you have of discovering insurance coverage that is very little much a lot extra costly compared to insurance coverage for chauffeurs that are thought about to be risk-free chauffeurs. The main point isn’t to hurry right into purchasing SR22 car insurance coverage associated items up till you have inspected out all the choices offered to you.

KRETENG.COM Website Review Bisnis, Tempat dan Harga Produk Terbaik di Indonesia

KRETENG.COM Website Review Bisnis, Tempat dan Harga Produk Terbaik di Indonesia